The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the July 15 date. Treasury.įor 2016 tax returns, the window closes July 15, 2020, for most taxpayers. If they do not file a tax return within three years, the money becomes the property of the U.S. In cases where a federal income tax return was not filed, the law provides most taxpayers with a three-year window of opportunity to claim a tax refund. The IRS estimates the midpoint for the potential refunds for 2016 to be $861 - that is, half of the refunds are more than $861 and half are less. To collect refunds for tax year 2016, taxpayers must file their 2016 tax returns with the IRS no later than this year's extended tax due date of July 15, 2020.

As the IRS is issuing Economic Impact Payments to Americans, the agency urges taxpayers who haven't filed past due tax returns to file now to claim these valuable refunds. In Notice 2020-23 PDF, the IRS extended the due date for filing tax year 2016 returns and claiming refunds for that year to July 15, 2020, as a result of the COVID-19 pandemic. To claim the refund, a return for tax year 2016 must be filed by July 15, 2020." There's only a three-year window to claim these refunds, and the window closes on July 15. "Time is quickly running out for these taxpayers.

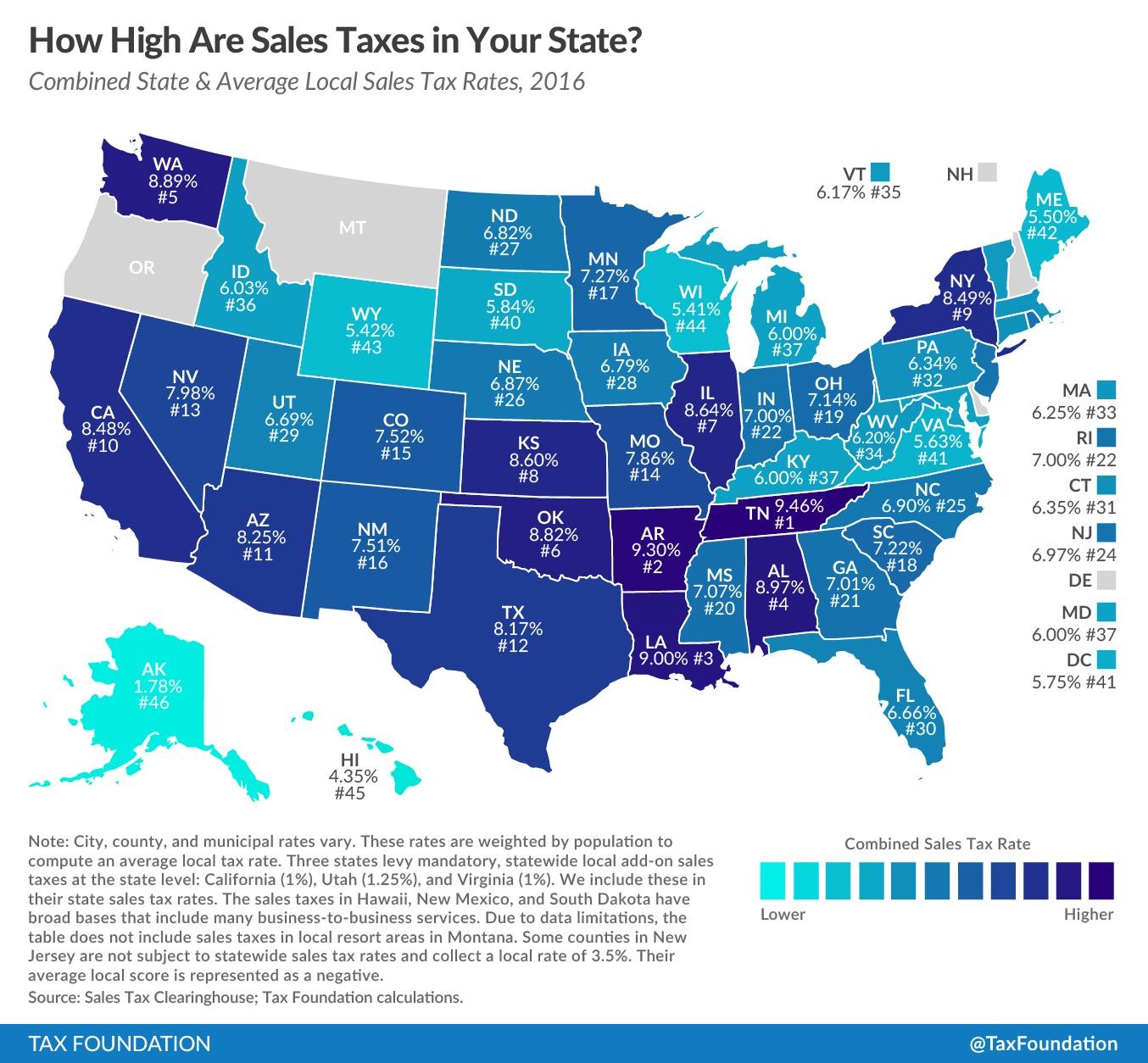

"The IRS wants to help taxpayers who are owed refunds but haven't filed their 2016 tax returns yet," said IRS Commissioner Chuck Rettig. 17, 2021.WASHINGTON - Unclaimed income tax refunds worth more than $1.5 billion await an estimated 1.4 million individual taxpayers who did not file a 2016 federal income tax return, according to the Internal Revenue Service. " State Gasoline Taxes Average About 30 Cents Per Gallon." Accessed Dec. " How High Are Property Taxes in Your State?" Accessed Dec.

" State Individual Income Taxes." Accessed Dec. 17, 2021.įederation of Tax Administrators. " A03009 Summary: Bill No A03009C - Part A." Accessed Dec. Governor Oliver, Senate President Sweeney, Assembly Speaker Coughlin, Assembly Budget Chair Pintor Marin, and Senate Budget Chair Sarlo Announce Agreement to Include Millionaire’s Tax in Revised FY2021 Budget." Accessed Dec. State of New Jersey, Office of the Governor. " 2021, 540, California Tax Rate Schedules." Accessed Dec. " State Individual Income Tax Rates and Brackets for 2021." Accessed Dec. Flat rate on interest and dividend income

0 kommentar(er)

0 kommentar(er)